Spark Your Business Success with the Capital One Spark Business Credit Card

Introduction

In today's competitive business landscape, having access to capital is essential for success. Whether you're a new startup or an established company looking to expand, finding the right funding solution can make all the difference. That's where the Capital One Spark Business Credit Card comes in. With its flexible features and attractive benefits, this credit card is designed to ignite your business growth and set you on the path to success.

Why Choose a Business Credit Card?

Before we dive into the specifics of the Capital One Spark Business Credit Card, let's first understand why having a dedicated business credit card is crucial for entrepreneurs and business owners. Here are some key reasons:

1. Separate Personal and Business Finances

Managing your personal and business finances separately is vital for financial transparency and legal compliance. By using a business credit card, you can easily track your business expenses, making tax season a breeze.

2. Build Business Credit

Just like individuals have credit scores, businesses have credit profiles too. By responsibly using a business credit card, you can establish and build your business credit history, which will be useful when applying for loans or other forms of financing in the future.

3. Access to Capital

Having a dedicated line of credit through a business credit card provides you with instant access to capital whenever you need it. This can be particularly helpful during cash flow gaps or unexpected expenses.

Key Features of the Capital One Spark Business Credit Card

Now that we understand the importance of having a business credit card, let's explore why the Capital One Spark Business Credit Card stands out from the crowd. Here are its key features:

1. Generous Rewards Program

The Capital One Spark Business Credit Card offers an impressive rewards program that allows you to earn unlimited cash back on every purchase. You'll earn a flat percentage on all spending, with no caps or categories to worry about. This means that every dollar you spend can contribute to your bottom line.

2. Introductory APR Offer

For capital one business credit card new cardholders, the Capital One Spark Business Credit Card offers an introductory 0% APR on purchases for a specified period. This feature can be especially beneficial if you have large expenses coming up or need to make significant investments in your business.

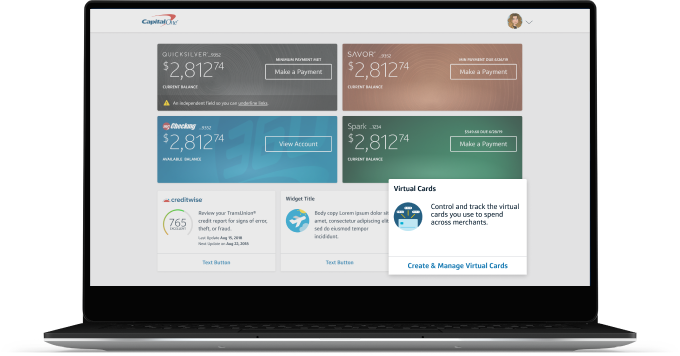

3. Customizable Employee Cards

If you have employees who need access to company funds, the Capital One Spark Business Credit Card allows you to issue employee cards with preset spending limits. This feature not only streamlines expense management but also provides a convenient way for your team to make necessary purchases without using their personal funds.

4. No Foreign Transaction Fees

If your business involves international travel or purchasing from overseas suppliers, the Capital One Spark Business Credit Card is an excellent choice. It doesn't charge any foreign transaction fees, saving you money and making your global transactions seamless.

5. Expense Tracking and Reporting Tools

Keeping track of business expenses is essential for accurate financial management. The Capital One Spark Business Credit Card provides robust expense tracking and reporting tools that allow you to analyze spending patterns and identify areas where you can optimize costs.

FAQs about the Capital One Spark Business Credit Card

Q1: How can I apply for the Capital One Spark Business Credit Card?

A1: Applying for the Capital One Spark Business Credit Card is a straightforward process. You can visit the official Capital One website and fill out an online application form. Make sure to have your business information ready, such as tax identification number and annual revenue.

Q2: Is the approval process for this credit card easy?

A2: While approval is not guaranteed, the Capital One Spark Business Credit Card offers easy approval compared to some other business credit cards. It takes into account various factors such as your credit history, business revenue, and financial stability.

Q3: What is the credit limit for the Capital One Spark Business Credit Card?

A3: The credit limit for the Capital One Spark Business Credit Card varies based on your creditworthiness and business profile. It's important to note that responsible usage and timely payments can lead to credit limit increases over time.

Q4: Can I use the Capital One Spark Business Credit Card for 3-way funding?

A4: Yes, the Capital One Spark Business Credit Card can be used for 3-way funding. This means you can use it to cover expenses that are not directly related to your business operations, such as personal purchases or investments.

Q5: Are there any soft pull business credit cards available?

A5: Yes, the Capital One Spark Business Credit Card is considered a soft pull business credit card. This means that applying for this card will not result in a hard inquiry on your credit report, which can negatively impact your credit score.

Q6: Can I transfer balances from other credit cards to the Capital One Spark Business Credit Card?

A6: Yes, balance transfers are allowed with the Capital One Spark Business Credit Card. You can transfer existing balances from other high-interest credit cards to take advantage of lower interest rates and consolidate your debt.

Conclusion

When it comes to sparking your business success, the Capital One Spark Business Credit Card is an excellent tool to have in your arsenal. With its attractive rewards program, customizable employee cards, and expense tracking tools, this credit card offers a comprehensive solution for managing your business finances. Whether you're looking to earn cash back on every purchase or streamline expense management, the Capital One Spark Business Credit Card has got you covered. So why wait? Apply today and unlock the potential of your business!