teeka tiwari reviews

teeka tiwari scam

teeka tiwari review

teeka tiwari next bitcoin

teeka tiwari twitter

teeka tiwari crypto picks

teeka tiwari cbd

teeka tiwari 2019

is teeka tiwari an expert in identifying the best crypto currencies?

teeka tiwari crypto course

palm beach confidential editor teeka tiwari

teeka tiwari april 2nd

teeka tiwari scammer

teeka tiwari black book

teeka tiwari t

teeka tiwari glenn beck cryptocurrency

http://reviewupviral.com/palm-beach-quant-reviews-teeka-tiwari/

teeka tiwari 5 coins to 5 million

palm beach reserch group teeka tiwari news letter june 2018

cbd teeka tiwari

glenn beck teeka tiwari bitcoin master course

teeka tiwari cyrpto

teeka tiwari scammer?

kenny [10:08 pm] teeka tiwari

teeka tiwari cbd 50 cent dstock which company? private placement

teeka tiwari editor, palm beach confidential review feedback

pbo teeka tiwari

teeka tiwari beck

teeka tiwari a scam

palm beach letter teeka tiwari email

teeka tiwari crypto suggestions

bitcoin projections teeka tiwari

teeka tiwari editor, palm beach confidentia

teeka tiwari buy up to price dash

teeka tiwari meme

what teeka tiwari is saying about bitcoin and the stock market?

how much does teeka tiwari charge

teeka tiwari was the youngest vp of lehman brothers

5 coins to 5 millions review teeka tiwari

teeka tiwari top 5 coins revealed forum

teeka tiwari barred finra

teeka's crypto picks teeka tiwari review

mining teeka tiwari crypto

teeka tiwari chainlink

teeka tiwari vechain

crypto currency teeka tiwari

training videos from teeka tiwari

what does teeka tiwari

is teeka tiwari a scam

anybody leaked teeka tiwari

teeka tiwari'

by teeka tiwari | november 01, 2017

teeka tiwari course

can i cancel teeka tiwari net worth

teeka tiwari video marketing scam?

teeka tiwari, scam

teeka tiwari palm beach - immediate pension plan

teeka tiwari linked in

teeka tiwari and the big black book of secrets

teeka tiwari smart

teeka tiwari monero

teeka tiwari enigma

teeka tiwari palm beach confidential filetype:rar

teeka tiwari uses bittix

teeka tiwari bitcoin newsletter

teeka tiwari trading license

teeka tiwari date pf birth

financial expert teeka tiwari

teeka tiwari palm beach confidential

palm beach letter teeka tiwari big black book

track record of teeka tiwari

http://kingsofim.com/palm-beach-confidential-review-teeka-tiwari/

did teeka tiwari really give away free bitcoin

alexandre raguet teeka tiwari

"palm beach confidential quarterly income" by teeka tiwari)

teeka tiwari cbd stock

teeka tiwari and judge jeanine

teeka tiwari 2020

ext:pdf teeka tiwari

agora teeka tiwari

teeka tiwari top 5 coins revealed

teeka tiwari bbb

teeka tiwari bits buy system

teeka tiwari banned from stocks

glenn beck and teeka tiwari crypto master course

teeka tiwari email

teeka tiwari kingmaker

top coins recommended by teeka tiwari

teeka tiwari what exchange for wa state residents

teeka tiwari ncome exodus

stock gumshoe teeka tiwari pocket change summit

teeka tiwari wikipedia lost trading license

teeka tiwari may 2017 reviews

what stock is teeka tiwari recommending

teeka tiwari webinar july 19

teeka tiwari q & a

teeka tiwari crypto omisego

teeka tiwari predictions

teeka tiwari instagram

teeka tiwari "new deal money"

teeka tiwari one-page guide to cryptocurrency

teeka tiwari 5 coins to invest in

palm beach research group teeka tiwari newsletter june 2018

teeka tiwari glenn beck bitcoin

|

Ryan: So you've looked at business that are big companies, you've examined much bigger marketcap type circumstances. Do you feel that that experience has helped you? Or are we in such, kind of the infancy, that as you pointed out, it is nearly simply sound judgment. You just have to sort of take a look at it and think logically about what's going on, and pull the emotion out? You have to pull the emotion out, and there are no conventional metrics that you can look at.

Okay. What I can utilize that I discovered from working on Wall Street across three decades, is how to read individuals - So I believe that's most likely one of my extremely powers, if you will. And if you've got a good BS detector, you ought to listen to it. Okay. You ought to absolutely listen to it. If I'm taking a seat and I'm talking with somebody, and they have actually got all the bonifides, however you know, there's simply; it's not agreeing with me, there's something about them that's not agreeing with me.

There are so numerous other offers out there to look at. Yeah, there's too much opportunity. Yeah. And speaking of opportunity, you understand, you type of mentioned at the beginning, Bitcoin and Ethereum, many individuals have heard of these two, particularly Bitcoin, since it appears like it's in the news all the time, something or the other.

Have they missed the boat on Bitcoin? Bitcoin is trading almost upwards of $6,000 just recently; it's shown up from state $3,000 not too long ago, it's quite unstable. Do they kind of await a pullback, or do they just state, "Okay, I'm going to purchase some Ethereum, I'm going to buy some Bitcoin, see you in 10 years." You understand? Yeah that's a terrific question.

You can literally use small stakes, and transform them into life-altering quantities of money. So I believe the primary step is, get clear on, if I lost all this money tomorrow, if I put it in Bitcoin, I wish to make certain that it's not going to have me begging my moms and dads for hamburger money, and sleeping on their couch.

And after that on the very first 50% pullback that you see in Bitcoin, buy the second half. Which method you're not going to get the best price, however you're going to get a great cost. And then simply leave it alone. And to your question, is it far too late to buy Bitcoin? Definitely not.

Today it has about just under a $100 billion market cap, so it's a 10x from here. Suggesting that Bitcoin is about ten times more unstable. And they believe that as it becomes less and less volatile, it's going to be much easier to really count on as a currency. Correct. Now, we're in an age where news, whether you call it FUD, worry, uncertainty, doubt, actually drives the rates of these cryptocurrencies up and down it appears like.

Even more, to an extent, than the stock exchange. Since there are larger gains and bigger drops. Do you feel that the marketcap needs to go up to help control that volatility? So that there's, it's spread out broader? Do you feel that the news needs to turn favorable? What do you feel is going to assist decrease that volatility, which in turn will cause more widely accepted use of an actual currency? It's type of like the chicken egg thing practically, but there's got to be some point where it transitions ( And it shows that you truly do understand the area asking that concern. So typically the life process of brand-new ideas is that it's the speculators and the early adopters that first enter it, before it goes into mass adoption, and after that becomes what we would think about genuine innovation, right? Right.

It went from pennies to a hundred and change, and after that back to like, five bucks, and now it's got over a half a trillion market cap. Yeah. So what you'll see is a comparable scenario with Bitcoin. Now we also saw Bitcoin go from pennies to $1,200, back down to $200.

It's now in its phrase of entering into its mainstream stage. Now, in order for it to be a currency, you're right, the volatility has to lessen greatly. And it can't diminish significantly up until it gets truly above a trillion market cap. Okay. So the concern is, what takes it to a trillion market cap if it can't be utilized as a currency? And it will be speculation that gets it there.

And so, as institutional cash begins entering into the market, which is what I expect will happen in 2018, and I'll tell you why I think that in a moment, that speculation will be self-reinforcing, and it will take Bitcoin to the point where volatility will come method, method, way down, and all of an unexpected, it's now something you can utilize legally to pay salaries and purchase things and actually utilize as a currency - undefined.

It's more of a speculative car that is also a storehouse of value. Mm-hmm (affirmative). Therefore when you take a look at, you type of spoken about position sizing and going into in and looking for, I think you discussed a 50% pullback ( In cryptocurrency, I remember not too long ago, Ethereum, I seem like it went from $300 to 10 cents or something in a day. That's right. However then, next thing you understand, it was back towards $400, and after that it's drawn back. So the volatility ranges are quite various. Do you sort of think that, 'cause what I'm attempting to get at here is, there are people who try and time the market.

And what I'm trying to figure out is, are you more just put something in, if there's a pullback, put some more in. Yep. If it draws back even further, look at your position sizes. If it makes sense, possibly purchase once again. But don't get too caught up in the plus green balance in your account, or the minus red balance, you know? Since- Yep, 100%.

Yep, 100. That is the method to go, due to the fact that we could have one statement tomorrow, and Bitcoin's $25,000, and after that you would have missed it, right? Mm-hmm (affirmative). So get in, get your feet damp. Get going with something that's not going to squash you if you're down 50 or 60% - Don't go put $200,000 in, and you're down 60% tomorrow, and you're prepared to jump off a building. Don't do that, that's simply not wise. Be logical, get your feet wet with this innovation. Know that you're not going to get an ideal print, right? Put your ego aside, throw it out the space, it's got no organization here.

You will see a 50% pullback in Bitcoin eventually. Now we may go to $15,000 first, before that next 50% pullback. But you will see one. So put your half position on, await the very first 50% pullback, put your other position on, and strap in for the ride, 'cause it's going to be amazing.

Yeah. And that leads me to emotion. I trade choices myself, too, and for me, stock trading and specifically option trading, fits my character profile. I'm very unemotional; I'm disciplined, I search for the finest, and after that enter the better. I'm really tactical about it. But the average individual as we understand, is reactive, when it comes to investing, they wish to purchase Amazon when it's now trading over $1,000, and they wish to sell it when it's at $800, and purchase it back when it's at $1,200.

And I take a look at the same obstacle with cryptocurrency, other than I see it on a more severe level, since it has an even larger FOMO mindset. Where individuals have this fear of missing out on out, they believe, I could have bought Bitcoin at cents, and if I would have purchased $100, I 'd have $70 million or whatever, you see these posts all the time.

That was most likely not excellent." And I had done that multiple times in these much lower numbers. But at that time these were profits, right? These were genuine earnings. And who understood that it 'd be $5,000, $6,000, $20,000, whatever. So there is even some of this internal FOMO of like, what's the next one? Oh, I've got to find it.

And beyond position sizing, how do you advise the folks that you inform about cryptocurrencies to safeguard themselves from this FOMO, emotional spiral that can take place? Yeah, so once again, a great deal of the time, every other week I put out a video, and I talk a lot about rationality, being reasonable.

On our journey to producing wealth, it's not the government or somebody else or our parents who are holding us back, right? It's all up in here. Due to the fact that money doesn't care what color you are, it does not matter what school you went to; it doesn't care if you read well, or if you are good looking, or if you are ugly.

So we bring all of our own drama to a development of wealth. So a few of the things that I do to help us protect ourselves from that is diversification, to be humble enough to say, "Look, I might suggest a concept that might go to no." Therefore we need to be diversified, and the other thing that we do is we use something called consistent position sizing.

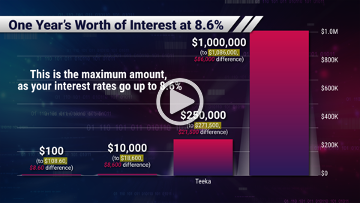

So I'll provide you a prime example. I suggested a very, very small cryptocurrency earlier this year at 13 cents. And I said, "Look, if you're a little player, most likely put $200 to $400, perhaps $500 max in it. And if you're a bigger player, you can put $1000 into it." Therefore that specific coin went to as high as $50.

Yeah, yeah. Right? So, I'm not going to say that every idea I take a look at does that. There are some concepts that have not exercised. But when you have a portfolio of concepts, and you use consistent position sizing, a couple of things occur. One, you're going to get fortunate, best? You're going to have a couple of trades that are simply fantastic.

Even if you have 10 concepts with $500 each in, $5,000, for many people, they lose $5,000, if everything went to absolutely no, yeah, it's gon na draw. It's not pleasant. However it's not going to put you in the poorhouse, right? You're not going to be sitting outside of Grand Central Station with your hat in your hand begging for burger cash.

Due to the fact that of the beauty here Ryan, you know I get passionate about this, you've got to forgive me, but the beauty here is we're so early. Mm-hmm (affirmative). We're so early, that we do not have to be that bright, best? We have to be intense adequate to have a core portfolio of great names, to have reasonable position sizing, and then be brilliant enough to do absolutely nothing however wait.