November 18, 2024

Property Owner Insurance: What It Is And Why You Require It

Tenants Insurance Overview Home Insurance Described

Constructing Codes

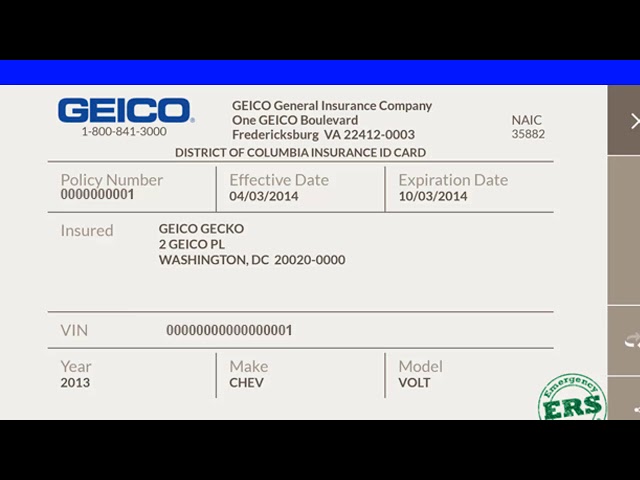

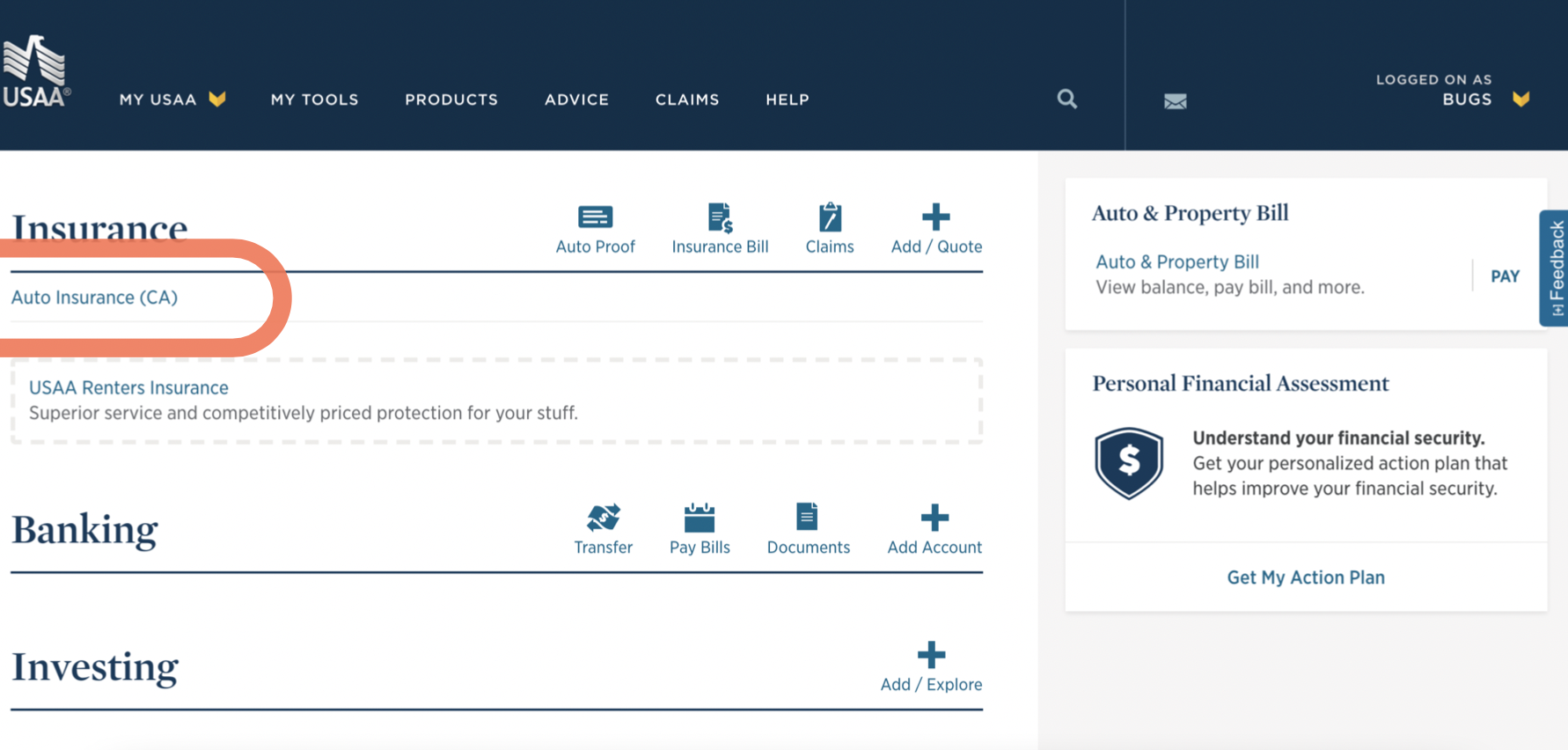

Home contents insurance coverage covers you against loss, burglary or damages to your individual and home belongings. It can additionally cover you if you take items out of the home, on holiday, for instance. It is an excellent idea to obtain home materials insurance policy to cover your belongings versus fire, burglary and various other risks, such as unintended damage. If something Notary Public in Riverside CA happens to damage or damage your possessions, it can set you back a lot of money to replace these products. Water damage is usually covered by landlord structures and proprietor components insurance, but it usually relies on exactly how the water damage happened.

You will certainly also need to think about the quantity of excess you are able to pay if you need to make a case. Greater excess decreases the expense of your insurance coverage and different insurance claims can feature various degrees of extra. Computing your rebuild price accurately will guarantee you do not overpay for your insurance. There are on the internet rebuilding price calculators to help, although bear in mind, this will just provide you with a price quote instead of precise values. Once again, standard home insurance is not likely to be valid when leasing an area in the very same building you reside in.

- Landlord insurance policy will not cover what's called 'normal damage'.

- Ensure you understand what your policy is providing to replace before you take it out.

- Property owners' liability insurance policy is commonly provided as typical in property manager insurance plan, however you should always check.

- This suggests that you will not be covered for the initial couple of extra pounds of a case.

What Does Landlord Materials Insurance Cover?

If you're getting your property manager insurance from Simply Service, you need to add home emergency situation cover to your property manager insurance in order to cover boiler break down. After that, if the boiler in your rental residential property stops working, a designer will certainly be sent out round to assist. The price of repairing your gas boiler will be covered, minus any excess and approximately the restriction of your plan.

What Does Landlords Insurance Coverage Not Cover?

Materials insurance coverage is there to assist shield your possessions if anything takes place to them. Despite just how cautious you are, there's constantly a threat that your personal properties could be stolen, harmed or broken. To provide you peace of mind, contents insurance policy ensures that, ought to the most awful pertained to the worst and your individual properties are damaged or stolen, you'll have the methods to cover and redeem the expense. If you're living in a rented residential or commercial property, buildings insurance policy is to your property owner. And there are lots of components insurance coverage to make sure you have actually obtained the appropriate cover. Additionally described as homeowner's responsibility cover, this kind of insurance covers legal support prices and expenditures in the event your renter has a mishap and considers it your fault. Your tenant might fail (stop working to pay) or your building may come to be unfit to live in after an occasion (like a fire or a flooding). If you're wanting to get cover for both, you'll need rent guarantee (which covers renters not paying) and lease defense (which covers uninhabitable residential properties).

Social Links